| Wednesday, July 12th, 2023—Louisiana Housing Corporation (LHC) Board of Directors approved the 2024 Qualified Allocation Plan (QAP) Awards. The QAP outlines the state's housing priorities and creates the rules by which Low Income Housing Tax Credit (LIHTC) applications are scored. Developers across Louisiana submit competitive applications in an effort qualify for tax credits based on their proposed document.

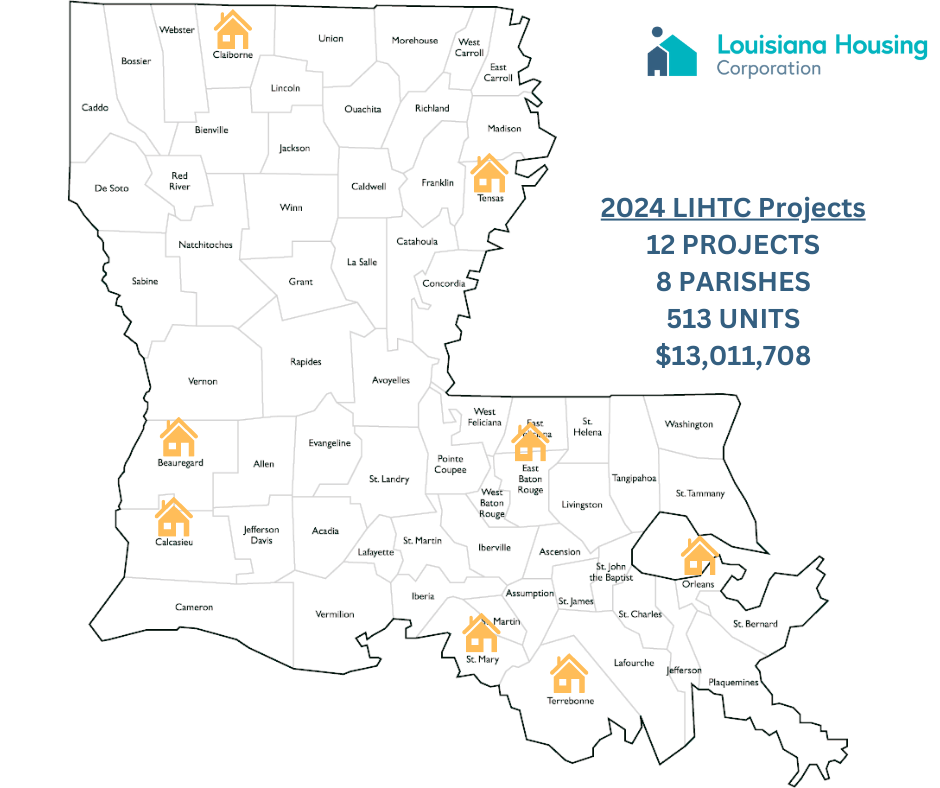

This year, LHC received 40 applications for LIHTC funds. LHC Board of Directors approved 12 projects to receive funding, a total of $13,011,708 for 513 units across multiple parishes in Louisiana.

Developments in the following parishes that will receive funding are Calcasieu, East Baton Rouge, Orleans, Beauregard, Claiborne, St. Mary, Tensas, and Terrebonne Parishes. "Because of incentives in the QAP, funding for Tensas, Claiborne, and Beauregard parishes reflect three areas of the state that had not received tax credit funding in 20 years," explains LHC's Housing Finance Program Administrator Louis Russell. LHC selected developments from six urban areas and six rural parishes for LIHTC awards. The Agency awarded eight new construction projects from a total of 20 and selected four acquisition and rehabilitation projects from a total of 11.

Points were available for material participation in the development team by a minority-owned business. This expansion was a set goal approved by the Board of Directors and an initiative of LHC Executive Director Joshua Hollins. "Applicants are incentivized if a minority-owned business had materials or participation or entered into a joint venture with the development team," said Executive Director Joshua Hollins. "Minority owned business were inclusive of woman-owned business, veteran, and service-disabled veterans." 39 of the 40 applications submitted showed material participation of minorities, while 37 of those applications submitted reflected a joint venture partnership with a certified minority entity; 12 of the 12 projects awarded expressed material participation and 11 of the 12 were joint venture opportunities.

LHC awarded certain projects based on their resiliency standards, meaning the building of these developments will have hardened building techniques to withstand natural disasters. Six applications submitted evidenced the Fortified Silver components, which three projects will move forward to receive funding. 33 applications demonstrated the Fortified Gold standard, and only 8 of these projects will receive funding.

The QAP provides information on the calendar year program, including minimum project requirements, competitive criteria, and underwriting criteria. The amount of credits to which a project is eligible is based on the amount of qualified development costs incurred and the percentage of low-income units within the development. Each qualified tax credit development must include a minimum percentage of units to be set aside for eligible low-income tenants. These set-aside units must also be rent restricted. The development must involve new construction or substantial rehabilitation of existing units occupied by income eligible individuals and families.

The QAP allows developers to receive a 9% tax credit, or 70% subsidy, from LIHTC. This does not include additional subsidies. |

|

|

|

Subscribe for the Latest